Unknown Facts About Top-rated Bankruptcy Attorney Tulsa Ok

Unknown Facts About Top-rated Bankruptcy Attorney Tulsa Ok

Blog Article

The Single Strategy To Use For Bankruptcy Lawyer Tulsa

Table of ContentsThe 3-Minute Rule for Which Type Of Bankruptcy Should You FileThe 5-Minute Rule for Top Tulsa Bankruptcy LawyersHow Bankruptcy Lawyer Tulsa can Save You Time, Stress, and Money.The 8-Second Trick For Tulsa Bankruptcy AttorneyBankruptcy Lawyer Tulsa Things To Know Before You Buy6 Simple Techniques For Bankruptcy Law Firm Tulsa OkGetting My Experienced Bankruptcy Lawyer Tulsa To Work

Ads by Cash. We may be made up if you click this advertisement. Advertisement As a day-to-day consumer, you have 2 primary chapters of insolvency to pick from: Phase 7 and Chapter 13. We very advise you very first accumulate all your financial documents and seek advice from an attorney to understand which one is best for your scenario.The clock starts on the filing day of your previous situation. If the courts disregard your bankruptcy case without prejudice (significance without suspicion of scams), you can refile promptly or submit a motion for reconsideration. If a judge rejected your situation with bias or you willingly disregarded the case, you'll have to wait 180 days prior to filing once again.

Jennifer is also the writer of "Prosper! ... Affordably: Your Month-to-Month Guide to Living Your Best Life Without Breaking the Bank." The publication uses recommendations, tips, and financial management lessons tailored towards assisting the reader highlight strengths, recognize bad moves, and take control of their finances. Jennifer's crucial monetary recommendations to her buddies is to constantly have an emergency situation fund.

All financial debts are not created equal. Some debts acquire favored status through the legislation financial obligations like tax obligations or youngster assistance. However some financial debts are a top priority based upon who is owed the financial debt. You may really feel much more obliged to pay a family members member you owe money to or to pay the doctor that brought you back to health and wellness.

Our Chapter 7 Bankruptcy Attorney Tulsa Ideas

And since of this many people will certainly inform me that they don't desire to include particular financial obligations in their insolvency case. It is entirely reasonable, but there are 2 issues with this.

Even though you might have the finest intentions on settling a particular debt after insolvency, life takes place. I do not question that you had honorable objectives when you sustained all of your financial debts. Nonetheless, the conditions of life have led you to personal bankruptcy since you couldn't pay your debts. So, despite the fact that you intend to pay all of your financial obligations, occasionally it does not exercise that means.

Most frequently I see this in the clinical area. If you owe a medical professional money and the financial debt is discharged in insolvency, don't be surprised when that medical professional will certainly no much longer have you as a person.

If you desire those dental braces ahead off sooner or later, you will likely require to make some kind of settlement arrangement with the excellent physician. The choice in both scenarios is to choose a new physician. To respond to the inquiry: there is no selecting and finding, you have to disclose all financial obligations that you owe since the moment of your bankruptcy declaring.

The 4-Minute Rule for Tulsa Bankruptcy Attorney

If you owe your family members money prior to your case is submitted, and you hurry and pay them off and afterwards expect to file personal bankruptcy you need to likewise expect that the bankruptcy court will certainly reach out to your household and try and get that cash back. And by try I suggest they will sue them and make them return to the cash (that will not make things unpleasant at all!) That it can be dispersed among all of your lenders.

There are court declaring fees and many people employ a lawyer to browse the complex process., so before filing, it's vital that you plainly understand which of your financial obligations will be released and which will certainly continue to be.

There are court declaring fees and many people employ a lawyer to browse the complex process., so before filing, it's vital that you plainly understand which of your financial obligations will be released and which will certainly continue to be.The Ultimate Guide To Top Tulsa Bankruptcy Lawyers

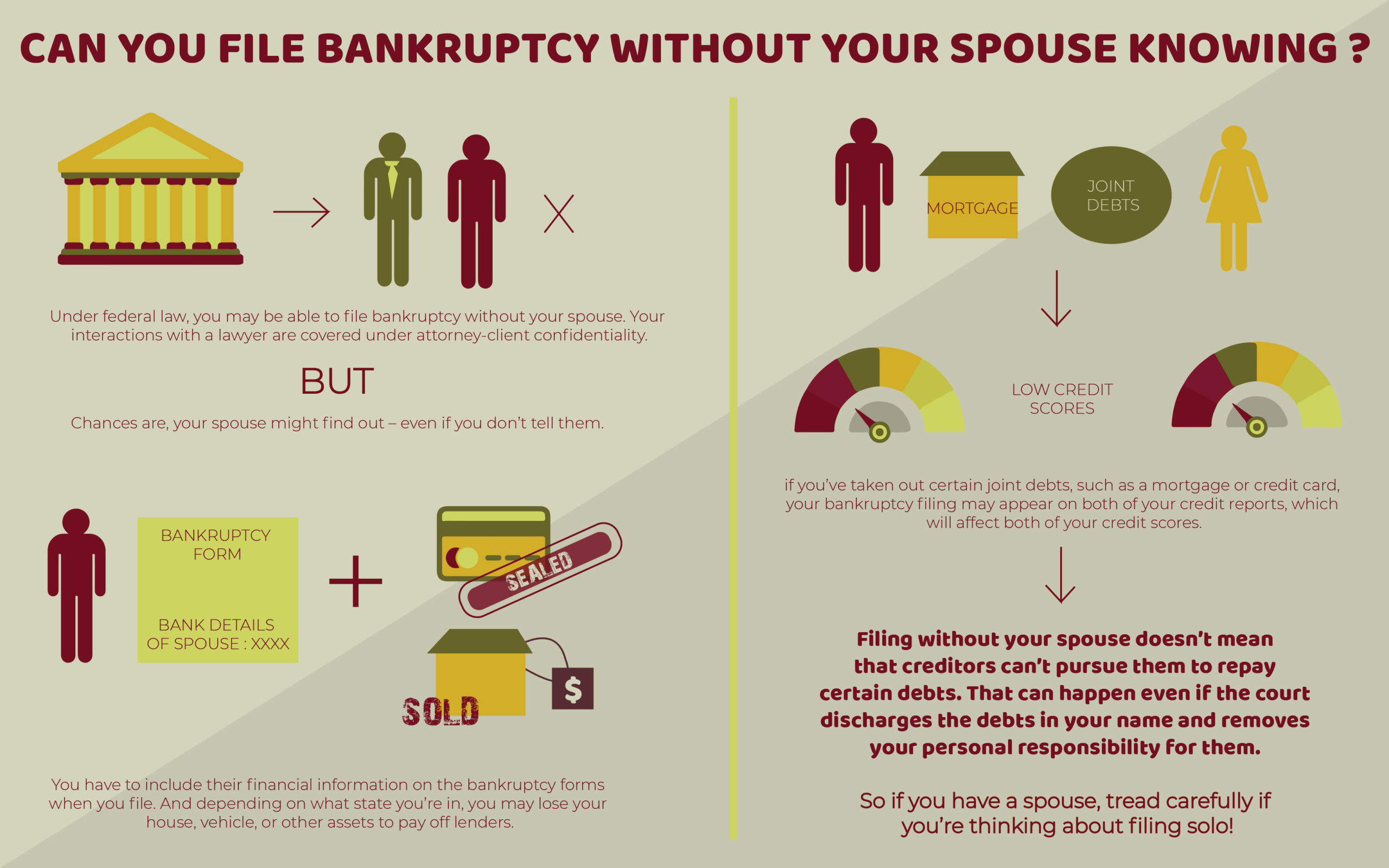

If you're wed or in a residential collaboration, your personal bankruptcy declaring could additionally affect your companion's finances, specifically if you have joint debts or shared assets. Go over the ramifications with your partner and consider consulting on just how to secure their economic interests. Bankruptcy ought to be considered as a last resource, as the effect on your funds can be considerable and long-lasting.

Prior to you make a choice, ask yourself these inquiries and weigh your other alternatives. Angelica formerly held editing and enhancing duties at The Straightforward Buck, Passion, HousingWire and various other economic publications.

In 2017, there were 767,721 personal bankruptcy filingsdown from the 1.5 million filed in 2010. Numerous research studies suggest that medical financial debt is a significant reason for a site web number of the insolvencies in America. Bankruptcy is designed for people captured in extreme economic conditions. If you have excessive financial debt, insolvency is a federal court process made to assist you eliminate your debts or settle them under the security of the personal bankruptcy court.

6 Simple Techniques For Chapter 7 - Bankruptcy Basics

The definition of a debtor who might submit bankruptcy can be discovered in the Personal bankruptcy Code. Attempts to manage your investing have failed, also after visiting a credit score therapist or attempting to stick to a debt combination plan. You are unable to meet debt obligations on your existing revenue. Your attempts to function with financial institutions to establish up a financial debt payment strategy have actually not functioned (Tulsa bankruptcy lawyer).

The definition of a debtor who might submit bankruptcy can be discovered in the Personal bankruptcy Code. Attempts to manage your investing have failed, also after visiting a credit score therapist or attempting to stick to a debt combination plan. You are unable to meet debt obligations on your existing revenue. Your attempts to function with financial institutions to establish up a financial debt payment strategy have actually not functioned (Tulsa bankruptcy lawyer).There are court filing charges and lots of people employ an attorney to browse the complex procedure. You need to ensure that you can pay for these prices or explore options for cost waivers if you certify. Not all debts are dischargeable in personal bankruptcy, so before declaring, it is necessary that you clearly comprehend which of your debts will be released and which will certainly remain.

Bankruptcy Lawyer Tulsa for Dummies

If you're wed or in a domestic partnership, your insolvency filing can likewise affect your partner's finances, especially if you have joint financial obligations or shared assets. Go over the implications with your partner and consider consulting on just how to safeguard their financial interests. Personal bankruptcy should be deemed a last resource, as the influence on your financial resources can be considerable and lasting.

Before you make a decision, ask on your own these questions and evaluate your various other alternatives. Angelica previously held editing and enhancing duties at The Simple Buck, Rate Of Interest, HousingWire and various other financial publications. bankruptcy attorney Tulsa.

Rumored Buzz on Chapter 7 Vs Chapter 13 Bankruptcy

In 2017, there were 767,721 individual insolvency filingsdown from the 1.5 million filed in 2010. A number of research studies recommend that medical debt is a significant reason of most of the insolvencies in America. Bankruptcy is created for people captured in extreme financial conditions. If you have excessive financial debt, personal bankruptcy is a click resources federal court procedure made to aid you remove your financial obligations or repay them under the security of the bankruptcy court.

The definition of a borrower who may submit insolvency can be discovered in the Bankruptcy Code. Attempts to manage your costs have fallen short, also after visiting a credit history therapist or trying to stay with a financial obligation combination strategy. You are unable to fulfill financial debt obligations on your current earnings. Your efforts to function with creditors to establish a financial debt settlement plan have not functioned.

Report this page